HELP US! - JOIN OUR MOVEMENT!

HOW? SIGN UP - THEN SPREAD THE WORD!

If we want to bring about reform of our tax system to help assist the beleaguered working-poor and middle-class, create a fair system of taxes, improve the economy, and strengthen the nation:

Firstly, we need to educate our fellow citizens directly and by encouraging press coverage to produce a large grassroots group of advocates.

Secondly, we need to have those advocates press lawmakers to reform our tax laws.

This page provides suggestions, tools, and information to do both.

WHAT I DO:

I CONSTANTLY SEND THE IDEAS PRESENTED IN WEBSITE TO FRIENDS, NEWS OUTLETS, PUNDITS, AND POLICY MAKERS. I POST ONLINE. I WALK THE STREETS OF ANY US CITY I VISIT WITH A FAIRSHARE SIGN AND HAND OUT POSTCARDS (BOTH BELOW). YOU CAN DO THE SAME TO MULTIPLY MY EFFORTS MANY-FOLD.

CRITICAL PAGES: HOME ROMNEY TAXES SUMMARY IMAGINE! HELP US!.

CONTACT INFORMATION:

Click here for a list of influential people who you can write to about the Fair Share Tax plan. There you can download and send FairShareTax Summary.pdf or one of these FairShareTaxes blurbs.doc.

Click here for fax numbers and addresses for Congress (the 2012 easy to use list).

Click here for the updated 2013 but less convenient listings for Congress.

Fax or mail the FairShareTax Summary.pdf to as many Congressmen as possible. Faxes are preferred for Congressmen since snail-mail is often delayed a month or more due to security concerns.

Here are two websites with contact information for call-in radio shows, newspaper letters to the editor, and more: Contact Newspapers/Other Media Contact Newspapers Use the information in the box under A above to draft your comments and try to mention FairShareTaxes.org

Here is link to a good website with general information about contacting policy makers: Contact Policy Makers

B. MAIL, EMAIL & TALK

Email the following paragraph to all the contacts in your email address book who may be interested. Post it on Facebook. Post it in online comments in websites. Download FairShareTaxes blurbs.doc if you would like to send longer versions describing our unfair tax system and the Fair Share Tax Plan.

Mail of fax my printed two-page FairShareTax Summary.pdf to your friends, the media, policy makers, law-makers, anyone you can think of.

Contact information for many public figures is at the bottom of this page. Include a comment or a cover letter stating your opinion and what you are requesting of the recipient (e.g. Friends: "Look at this website and spread the word to anyone who might be interested." Media: "Please report on current unfair tax policy and proposals to fix it." Lawmakers: "Please study this site and introduce legislation!")

I've picked 3 well-know progressives. Please print and fax (or mail, if necessary) them this FairShareTax Summary.pdf

Mr. Warren Buffett (progressive billionaire) FAX 1-402-346-3375

Berkshire Hathaway; 355 Farnam Street #1440; Omaha, NE 68131

Dr. Robert Reich (progressive professor, public servant) FAX

1-510-643-9657 University of California, Berkeley; 2607 Hearst

Avenue Berkeley, CA 94720-7320 rreich@berkeley.edu

President Barack Obama - Online Comments to the White House

1600 Pennsylvania Ave. Washington D.C.

You could add this to your e-mail signature:

Check out this thought-provoking website: http://fairsharetaxes.org

Write a letter to the editor of a local or national newspaper mentioning this website. Contact information for many newspapers can be found at this webpage.

Talk about tax fairness, how it would improve lives, strengthen our nation ...

D. TOTAL COMMITMENT

Download and manufacture Fairshare Bumper Sticker.pdf for your car rear window or bumper.

Post one of these posters in public places:

-

•Fair Share Taxes Postcard - see page bottom

Leave FairShare Cards.pdf in coffee shops, in the bus, in the lunch room, around town, etc. [All down-loadable forms on this site have been virus-scanned on a Mac before they were up-loaded to the site.]

Go to your local Protest for Economic Fairness of Political Rally and carry this FairShare Protest Sign.pdf (or tape it vertically to your back; Sign downloads as 2 letter-size pages to print and tape together; tape not included)

Mention the website in web-posted comments and radio talk-shows.

Posters

Bumper sticker

Protest sign

SEE FULL NAVIGATION MENU BENEATH PHOTOS AT TOP OF PAGE

WHAT YOU CAN DO:

IF YOU AGREE WITH THE TAX SYSTEM REFORM PROPOSED HERE, THEN PLEASE JOIN THE MOVEMENT BY HELPING TO SPREAD THE WORD. HERE ARE SOME IDEAS:

CRITICAL PAGES: HOME ROMNEY TAXES SUMMARY IMAGINE! HELP US!.

COPYRIGHT - FAIR SHARE TAXES - ALL RIGHTS RESERVED

Post-card - see below

WANT 4x6 POSTCARDS LIKE THIS TO HAND OUT?

Email me your snail-mail address (held strictly confidential)

< Front - Back^

QUIZ: For 30 years the Republicans have claimed their tax cuts to the wealthy would stimulate the economy and create jobs. Over those thirty years how much has the best measure of the strength of the economy, GDP growth, changed (compared to the prior 30 years)? How much have those tax cuts contributed to the National Debt?

ANSWER: GDP growth has dropped 25% since the Republicans started cutting taxes on wealthy investors, claiming it would stimulate the economy. The cost to the US Treasury has been about $10,000,000,000 (ten trillion-over half our national debt), which we and future tax payers (especially wage-earners under the current tax system) will eventually need to pay - with interest. This Republican’s failed stimulus cost more than 10-times more than Obama’s much-criticized stimulus that saved us from a second Depression of the Republican’s making.

FAIR SHARE TAX REFORM: A comprehensive tax reform plan for federal, state and local governments, that reduces total taxes on the working-poor and middle-class by thousands each year, encourages stable economic growth, vastly simplifies our tax laws, and slashes the national debt.

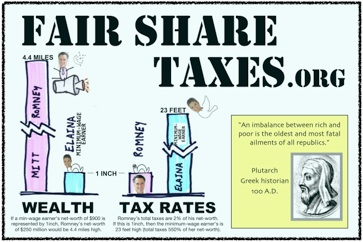

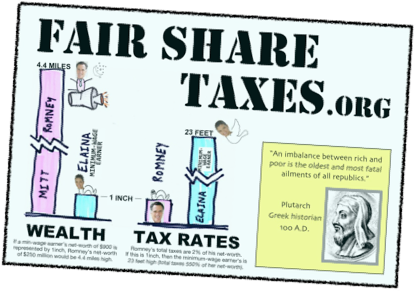

Billionaire Warren Buffett pays 12% total taxes (fed, state, local, and corporate) on estimated $36 million investment gains. A minimum-wage worker pays 34% total taxes on a $14,500 annual salary. This is not only unfair, but is destroying our economy and democracy. The top 1% already owns 40% of the nation's wealth. This leads to repeated investment bubbles and the recessions that are crushing the working-poor and middle-class. See this website for much more and a really fair, economy-fixing, nation-saving tax reform proposal, that would cut each middle-class household’s annual total tax bill by thousands and slash the deficit: http://fairsharetaxes.org

A. JOIN US TO GET UPDATES

Get on the email list for updates. I’ll email back updates (no more than twice a month) [I will never give out your email address to anyone.] This tax reform project is a work in progress. I often incorporate good ideas I receive in the proposal. Send me your ideas for the proposal, interesting related links, ideas for spreading the word ...

E-mail me at: FairShareTaxes@att.net

Friend me on Facebook: FairShareTaxes

Suggested Tweets: [Twitter link]

Total taxes: World's 3rd richest man paid 11% of investment gain; Min-wage worker paid 37% of wages. fairsharetaxes.org #tax

Millionaire investors can pay a 2-fold lower total tax rate than middle-class workers pay on wages. fairsharetaxes.org #tax

Thanks to our tax system, the top 1% wealthiest Americans now own 40% of the nation’s wealth, up from 22%. fairsharetaxes.org #tax

Our tax system awards investment..repeated investments bubbles..recessions..you lose your job, savings, home. fairsharetaxes.org #tax

Nations like ours with less economic equality have worse health, life expectancy, drug abuse, even among the rich. fairsharetaxes.org #tax

Our tax system impedes social mobility..fewer to reach their full potential..weakens the economy and the nation. fairsharetaxes.org #tax

Our tax system underfunds gov'ments..neglect of national priorities that would improve and save lives. fairsharetaxes.org #tax

Our tax system costs taxpayers billions of man-hours and hundreds of billions of dollars annually to file returns. fairsharetaxes.org #tax

A simplified reformed tax system with a 1-2% tax on the wealth of millionaires would save the middle class. fairsharetaxes.org #tax

A simplified reformed tax system with a 1-2% tax on the wealth of millionaires would save the economy/nation. fairsharetaxes.org #tax

C. FACEBOOK, TWITTER, ETC

Put links to this website in blogs, your website, Twitter, or Facebook page.

Here's a paragraph you can paste to an e-mail or your Facebook wall:

Billionaire Warren Buffet pays 11% total taxes (fed,state,local,corp) on $8 billion investment gains. A minimum-wage worker pays 37% total taxes on a $14,500 annual salary. Unfair. Destroying our economy and democracy. For much more and a really fair, simple, economy-fixing, nation-saving tax reform proposal, that would save each middle-class household thousands and slash the deficit: http://fairsharetaxes.org

Click for longer versions: FairShareTaxes blurbs.pdf to send to anyone who might be interested

Go to Readit, hit “submit a link” (upper right) and post this link:

http://fairsharetaxes.org along with an attention-grabbing headline. (If not a member you’ll need to sign up first.)

CONTACT ME: fairsharetaxes@att.net