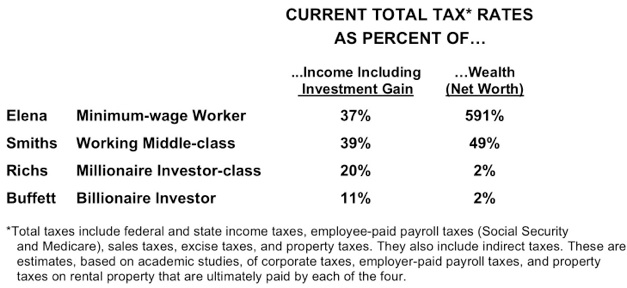

LOOK AT THE FOUR TAXPAYERS BELOW & WHAT THEY PAY IN TOTAL TAXES UNDER THE CURRENT TAX SYSTEM

THEN SEE "THE SOLUTION" AT LINKS BELOW

Why does the minimum-wage worker pay a total tax rate (combined federal, state, municipal, corporate, etc.) of 37% of her wages, while the third-richest man in the world pays only 11% of his income and investment gain? Why does the working middle-class family pay 2-fold higher tax rate than do a millionaire couple who are living very well off of their investments?

For a summary of the tax rates of the four, see below. The 2013 tax deal makes no significant changes in the rates reported below.

For a detailed spreadsheet, where the taxes for the four are worked out, click here: spreadsheet page

Why does the working middle-class family pay 2-fold higher tax rate (% of income) than do a millionaire couple who are living very well off of their investments?

Why does the minimum wage worker pay nearly 600% of her savings in taxes while the third richest man in the world pays 2% of his savings (% of net-worth)?

Obviously because our current tax system is broken.

THE SOLUTION:

The Fair Share Tax Plan:

•Fixes these absurd inequities and has everyone pay taxes in proportion to the profit they have taken from the services governments provide.

•Fixes the economic distortions that lead to repeated recessions.

•Fixes the threat to our democracy that concentrates money and power in the top 1%.

•Massively simplifies our byzantine tax code and the waste it causes.

•With reasonable spending reforms, pays off the National Debt. (See Spending and Debt page.)

See details of the tax plan on the Fair Share Tax Details page.

See how the above rates would change on the What if all paid their Fair Share page.

Then if you like the Fair Share Tax Plan, do something. See the Join-Help Us page.

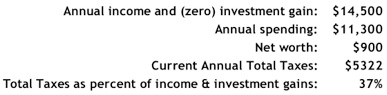

THE WORKING-POOR CLASS - ELAINA

24 year old single Home Health Aide making minimum wage

Does not qualify for Medicaid, Food stamps, or the Earned Income Tax Credit

FOR THE FOUR TAXPAYERS ABOVE:

Here is a calculation of the current tax rates by adding together all the federal, state, municipal, corporate and other indirect taxes paid in a year and then dividing the result by the two best measures of a household's ability to pay and extent to which a household profited from government services: 1) their annual income including all investment gains; and 2) their total wealth (net worth):

$605

$1109

$280

$518

$1300

$1109

$400

Federal Income Tax

Payroll Tax

State Income Tax

Sales & Gas Taxes

Indirect Property Tax

Indirect Payroll Tax

Indirect Corporate Tax

37%

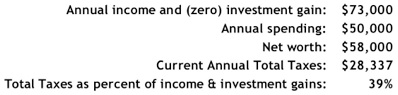

THE MIDDLE-CLASS SMITHS

45 year old parents of two, Construction Supervisor, Teachers' Aide

$4741

$5575

$3044

$1902

$5500

$5575

$2000

Federal Income Tax

Payroll Tax

State Income Tax

Sales & Gas Taxes

Property Tax

Indirect Payroll Tax

Indirect Corporate Tax

39%

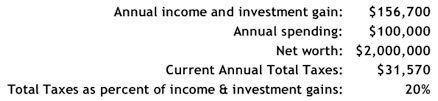

THE MILLIONAIRE RICHS

45 year old retired couple, living off investments

$1274

$0

$1011

$3676

$7900

$0

$17,700

Federal Income Tax

Payroll Tax

State Income Tax

Sales & Gas Taxes

Indirect Property Tax

Indirect Payroll Tax

Indirect Corporate Tax

20%

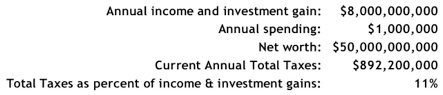

THE BILLIONAIRE - WARREN BUFFETT

Investor, Philanthropist, World’s third richest man, Agrees his taxes are too low

$8.1M

$7500

$3.1M

$57,000

$80,000

$7500

$881M

Federal Income Tax

Payroll Tax

State Income Tax

Sales & Gas Taxes

Property Tax

Indirect Payroll Tax

Indirect Corporate Tax

11%

[An analysis of 2000-08 yielded and estimated total tax rate of 10% over the period]

Elaina, the Smiths and the Richs are typical, hypothetical taxpayers in 2006 or 2007. Warren Buffett's taxes are based on the personal tax information he disclosed for 2006 (the last time he did so) and his company's annual report. Since then, even with the 2013 tax deal, the tax system has not changed in any significant way, except perhaps that an increasing tax burden has been placed on the working poor and middle class in the form of increased sales and property taxes. Under 2013 rules, Mr. Buffet’s total tax rate would still have been 11%. For all four, their financial situations and tax calculations are outlined in the Four Taxpayer Spreadsheet page (where you can also download the spreadsheet), and in the Tax Reform Essay.

CRITICAL PAGES: HOME ROMNEY TAX SUMMARY IMAGINE! HELP US!.

SEE FULL NAVIGATION MENU BENEATH PHOTOS AT TOP OF PAGE

COPYRIGHT - FAIR SHARE TAXES - ALL RIGHTS RESERVED

QUIZ: Thirty years ago, before tax cuts on the wealthy began, the top 1% owned 22% of the nation’s wealthy. What percentage of the nation’s wealth do they own now?

ANSWER: 40%. Simulations show most of this increase can be accounted for by the favored tax rates the wealthy investor class gets over wage earners.

FAIR SHARE TAX REFORM: A comprehensive tax reform plan for federal, state and local governments, that reduces total taxes on the working-poor and middle-class by thousands each year, encourages stable economic growth, vastly simplifies our tax laws, and slashes the national debt.

CONTACT ME: fairsharetaxes@att.net